Everybody, and I mean everybody, wants to have more money in their bank account. They work long hours, make sacrifices and spend about a third of their adult life at work in chase of the mighty dollar. But what if I told you that there is something that could potentially save you thousands, that almost no one is doing? Well, it’s true.

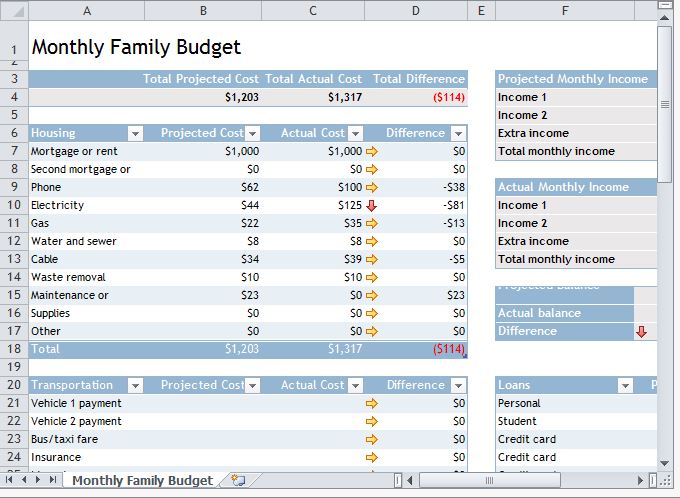

So what is this “thing”? It is a budget. A budget, in its simplest terms, is a a plan or method of tracking not only how much money is coming in, but also a breakdown of where it is all going. Now, a budget can be made for a person, family, business and even a country. But for this article, I will be focusing on budgeting for a family or individual.

Perhaps the biggest issue why people seem to lose control of their finances and be in a bad spot is because of spending. Even spending that $5 on coffee each and every day can add up. On the other hand, a major investment, like buying a new house, requires years of budget planning and substantial savings. If you have a budget in place, you should know where each and every dollar you spend is going. Not only will this hopefully point out any negative spending habits you have, it will also make very clear what area of your finances is struggling.

Now, you may think that this process of budgeting and creating a budget is extremely difficult and tedious, but it isn’t at all. Creating a budget and sticking to it can only take a few minutes up to a few hours if you get really deep into it. And if you ask me, saving a ton of money for a maximum of a few hours of work is a pretty good trade off.

Now as for how you create your budget, there are a few different ways. The traditional way has always been with just a pen and paper. You write how much income you have coming in, how much you spend, where the remaining goes and whatever else you would like to keep track of. However, in recent years, a number of different computer/smart phone applications and programs have been released that can help you streamline this process and have your budget at your fingertips wherever you go.

With the existence of these apps, there is really no reason for you not to have a budget in place to keep track of your spending. So take a few minutes out of your day to create one, your wallet and bank account will thank you.